Fewer Treasuries, More Stocks

Fewer Treasuries but More Stocks on Foreigners's U.S. Shopping Lists - New York Timesh/t Cafe Hayek

One of my favorite blogs is Cafe Hayek where I found a link to the NYTimes article linked above. I thought it was interesting so I wanted to explore the economic analysis of foreign purchases of US treasuries by foreign entities.

Therefore, I went to the US Treasury web page and downloaded all the data that can be found here. From the NYTimes:

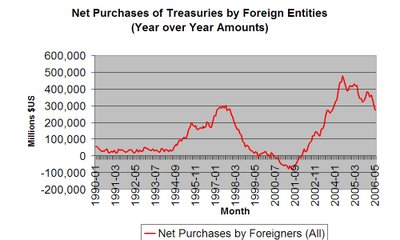

The charts show totals over rolling 12-month periods, smoothing out what can be volatile monthly figures. In the 12 months through May, foreign official institutions, mostly central banks, bought a net $137 billion of long-term American securities, including Treasuries, government agency bonds, corporate bonds and common stocks. That number, while sizable, is well below the record of $245 billion purchased in the 12 months through September 2004.Since the web version of the Times does not have any graphs, I made my own. The first graph shows the historical net purchases of US Treasuries by Foreign Entities. The data is year-over-year to smooth out monthly variations:

This graph (click for a bigger, readable view) indicates to me that foreigners have cut their purchases of US Treasuries starting in June, 2004. The trend is two years old. As Cafe Hayek noted, there was some concern that foreign central banks were buying too many treasuries which, as the argument went, presented a risk to monetary stability. Here is the graph of foreign central bank net purchases:

The trend is similar (click for a bigger, readable view). That is, in late 2004, foreign central banks turned away from treasuries in both absolute dollars, but percentage of purchases as shown below:

What conclusions can we draw from this data:

1) Foreign entities (banks and individuals) are financing less and less of the government debt.

2) Foreign banks have shifted their preference from treasuries to government backed mortgage and US corporate debt.

Another argument was made at Cafe Hayek (not by the authors of that blog):

...most of the foreign investors who buy dollar-denominated securities are foreign central banks.I do not think this is a correct assertion. If I understand the data correctly, only 13% of the foreign purchases of US securities is central banks. Not only that, the percentage peaked at 29.7% in August, 2004 and has been declining ever since.

I apologize for the poor graphics, but I cannot quite master moving charts from Excel to a format to post on the web. If there are any technical geniuses who can give me tips, I would appreciate it.

0 Comments:

Post a Comment

<< Home